Geographical Focus: Europe

Categories:

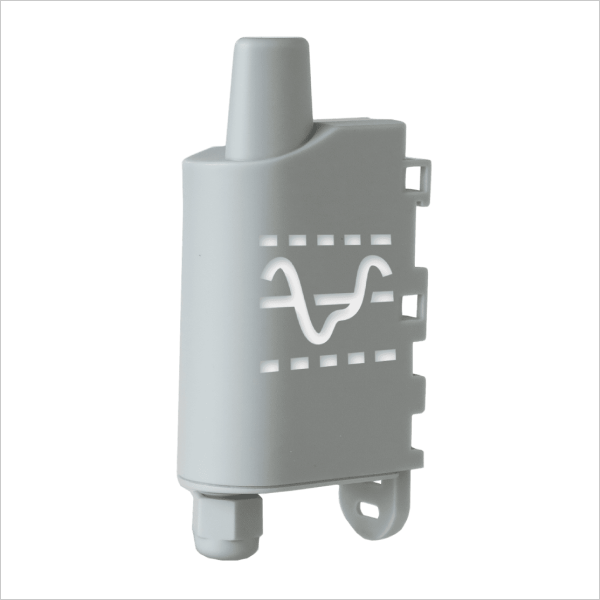

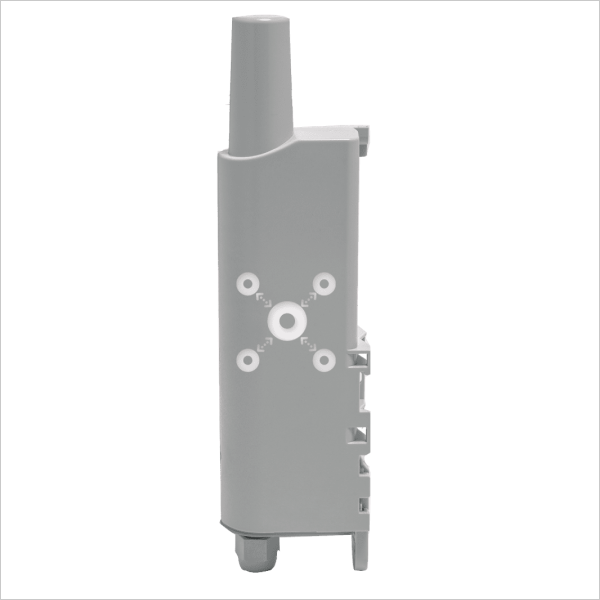

End node (sensors or other devices), Hardware

Commercial Contact:

sales@adeunis.com

Technical Contact:

support@adeunis.com

ADEUNIS

In a connected world, Adeunis designs, manufactures and markets sensors and wireless solutions to support the operational performance of professionals.

Our business sectors:

Adeunis is the expert in IIoT solutions dedicated to the smart building, smart industry and smart city sectors.

- Smart building: boost the performance and the comfort of buildings

- Smart industry: master infrastructures and optimise industrial processes

- Smart city: optimise services contracts: transport, collection, mobility, fleet of distributed equipment

Our mission: to support our customers in the digitalization of their businesses through industrial IoT solutions, guaranteeing the complete information chain, from sensors to the transfer of data to their application.

The promise to our customers: manage and optimize your assets & services through adeunis® connected solutions

Verticals: