- What is the basic LLC registration process?

- How is LLC registration different in Nevada?

- What is the best address for your Nevada LLC?

- Using Alliance Virtual Offices’ digital tools to benefit your Nevada LLC

Q: Is Nevada a good place to register my LLC? How do I go about completing my Nevada business registration?

A: Nevada is a great place to register your LLC. Not only is it a private state for business owners, but the tax benefits are very attractive too. The process of registering for your Nevada LLC isn’t much different from the process of registering for a business in another state.

Digital businesses have never been more profitable. Ecommerce is expected to account for over a trillion dollars in revenue at the end of 2023 in the United States alone. That trend is showing no signs of slowing down.

As these trends continue showing positive momentum, motivated entrepreneurs are in an excellent position to start new businesses. Established business owners are in an equally favorable position themselves.

The reason for this is the simplicity with which you can start a digital business. Correspondingly, established entrepreneurs have never had such an easy way to begin focusing on digital-first operations.

According to Pew Research, remote work continues to change how Americans work in the aftermath of the pandemic. 61% of workers with access to a physical office continue to choose to work from home, and employers continue to make accommodations for these employees.

In conjunction with the heightened remote work numbers, it doesn’t look like workers are showing any signs of meaningful ‘Zoom fatigue’ or other screen-specific forms of burnout.

In this increasingly digital market, starting a business is more straightforward than ever. With the introduction of digital tools like Virtual Offices, potential business owners have been awarded a cost-efficient way to register an LLC in any state they’d like – without being forced to enter expensive commercial leases.

Thanks to this streamlined method of LLC registration, entrepreneurs are left only to determine in which state they’d like to register. To find the right place, would-be business owners should look for states with attractive tax benefits, a simple registration process, and privacy protections for their companies.

Nevada is a state that carries all of these benefits. Forming a Nevada LLC doesn’t carry high registration fees, the taxes are superb, and Nevada is one of the most private states for business owners.

In this article, we’ll be examining the basic LLC registration process, what makes getting an LLC in Nevada different, the best address to use for your Nevada LLC, and how Alliance Virtual Offices’ suite of digital tools can benefit your business.

So, if you’ve ever wanted to start a Nevada LLC, act now and keep reading!

- What is the basic LLC registration process?

- How is LLC registration different in Nevada?

- What is the best address for your Nevada LLC?

- Using Alliance Virtual Offices’ digital tools to benefit your Nevada LLC

What is the basic LLC process?

Before you get too far into your Nevada LLC search, let’s take a minute to examine the basic LLC process to get an idea of how registration generally works.

Now that owning a business is more accessible than ever, absorbing this information can give potential business owners a chance to understand the process fundamentally before rushing in. Besides, if you’re unsure of what kind of business you’d like to start, you have access to ample resources that will give you some actionable ideas.

Read more: I Want to Start a Business But Have No Ideas… What Should I Do?

Forming an LLC requires you to register your business with the federal government. There are a few federal regulations that you have to abide by, but most of the registration process happens at the state level.

Below, we’ve created a guide that details the basic LLC process to better equip you for the nuances you might experience during your Nevada business registration.

- Create a unique name

- Appoint a registered agent

- File your articles of organization

- Get your EIN

Creating a unique business name

First things first, you need to come up with a unique business name. Your business name must be different than any other business currently in operation.

According to the U.S. Small Business Administration, you should pick a name that identifies your business and reflects your brand identity.

Once you’ve thought of a name but before you’ve started the state-level registration process, it’s worth it to search for similarly named businesses on the IRS website.

Occasionally, using a business’s name in the search isn’t as effective as simply using the business’s EIN. If this is the case and you have access to a company’s EIN – you can use this link to search the IRS database by number.

Appointing a registered agent

Next, you will then need to appoint a registered agent.

Your business’s registered agent is someone you designate to act as your business’s representative. Typically, this person needs to live within the state where the LLC is registered.

Outside of living in the same state your business is registered in, most states require their registered agents to be above the age of 18 and available during regular business hours.

This begs the question of whether or not you can act as your business’s registered agent.

Many business owners assume that this is a handy way to save money, but in reality, the safest bet is often simply using a registered agent service provider.

Read more: Can I Be My Own Registered Agent?

File your articles of organization

Next, you’ll need to file your articles of organization with the government.

This is done through the website of the state where you intend to register. Articles of organization are documents that explain how the LLC is managed.

In addition to explaining how your business will be managed, most states will ask for a good deal of information, from your business’s name to your business’s purpose.

In a majority of states, incorrectly filing your articles of organization will require your business to spend additional money amending your entity’s formation documents.

To make matters easier to remember, think of your company’s articles of organization as your company’s birth certificate. It includes all pertinent information and you’ll generally pay your state-specific filing fee when you file your business’s articles.

Get your Employer Identification Number

Finally, you’ll be assigned an EIN, or Employer Identification Number. If your articles of organization are your company’s birth certificate, then your EIN is your company’s social security number.

As your business continues operating, you’ll use your EIN to file annual reports. Any potential business loans or lines of credit will also be secured through the use of your EIN.

If you find yourself in a tight spot and are looking for payroll loans or other quick avenues of funding, good business credit is crucial to finding well-priced loans with reasonable fees.

Without good business credit, you’ll find yourself dealing almost exclusively with high-interest loans and other expensive credit-acquiring options. The importance of building strong credit for your company cannot be understated.

Read more: Payroll Loans for Small Business: Why Your Business Credit is Crucial

While the information above will give you a decent understanding of the process you’ll need to take in every state, there are some slight differences in the Nevada business registration process that we’ll detail below.

How to register for an LLC in Nevada

For the most part, LLC registration in Nevada is much the same as it would be anywhere else.

Regardless, it’s worth familiarizing yourself with the process you’ll need to register and learn the Nevada LLC cost.

We’ve made another guide below that details registering your LLC in Nevada.

- Choose a business name

- Appoint a Nevada LLC registered agent

- File your LLC’s articles of organization

- Draft your company’s operating agreement

- File for your EIN

Choose a business name

As expected, the first step to creating your Nevada LLC is choosing a business name.

To better check your potential business name against existing business names, feel free to use this Nevada Business Search, provided by Nevada’s Secretary of State for potential business owners.

Remember, outside of being unique, your business’s name needs to include “LLC” in its official name, it can’t be profane, and it shouldn’t mislead customers.

Outside of these guidelines, try to give your business a memorable name that isn’t too much of a mouthful, and try to personify your brand through your company’s name.

Not only does Nevada’s Secretary of State website provide the in-state business name lookup, it also hosts a Name Reservation feature. This application allows you to reserve a name with the SOS Office for 90 days for a $25.00 fee.

Once you’ve followed the guidelines and created a unique name that speaks to customers and is easy to remember – it’s time to find your Nevada LLC registered agent!

Appoint your Nevada LLC registered agent

Next, it’s time to appoint a registered agent.

In Nevada, your registered agent needs to meet a few basic guidelines.

- Must be over the age of 18

- Must have a street address in Nevada

- Must have your name and address on the business’s articles of organization

Nevada is a state that does allow business owners to act as their company’s registered agent, but you should not do this. The reason for this is that any official government correspondence or other legal matters will go through your registered agent directly.

If you act as your business’s registered agent and get sued, you’ll receive important documents or intents to file in the mail. You will be responsible for receiving that mail and handling any issues it brings.

Using a service takes this burden out of your hands. Instead of worrying about any mail you may or may not have missed, you can use a professional service that ensures your official correspondences are handled effectively.

Instead, check out some registered agent services like Inc Authority.

File your LLC’s articles of organization

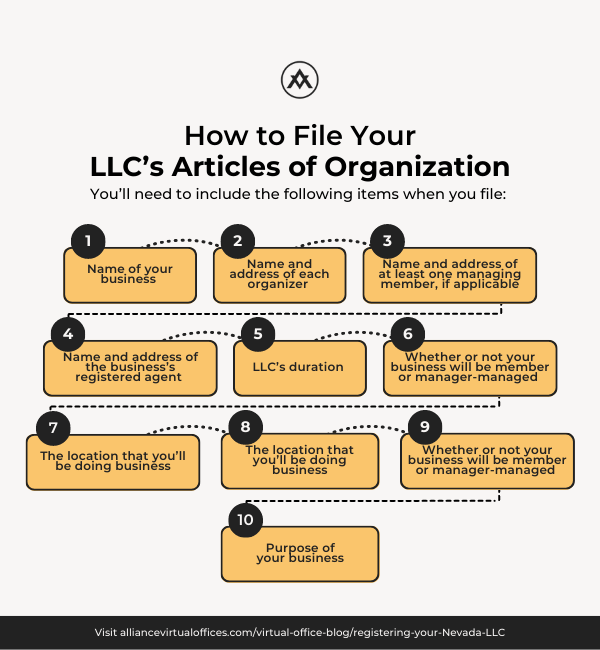

After creating a unique business name and appointing a Nevada LLC registered agent, it’s time to file your business’s articles of organization.

Remember, your articles of organization provide all the initial information about your business. In Nevada, you’ll need to include the following items when you file:

- Name of your business

- Name and address of each organizer

- Name and address of at least one managing member, if applicable

- Name and address of the business’s registered agent

- LLC’s duration

- Whether or not your business will be member or manager-managed

- The location that you’ll be doing business

- Any possible DBA designations

- Type of business structure/if you’ll be providing professional services or not

- Purpose of your business

Remember, when you file your articles of organization for your Nevada LLC, you’ll need to send in your $75.00 fee as well.

You can find a copy of this form online here and submit it via email to [email protected] along with the required filing fee.

If you’d like to submit your articles by mail, you’ll need to send the form and the fee to this address:

Secretary of State

202 North Carson Street

Carson City, Nevada 89701-4201

Draft your company’s operating agreement

After you’ve submitted your articles of organization, you should go ahead and draft an operating agreement.

Technically, creating an operating agreement for your business isn’t required for an LLC in Nevada, but it’s a good idea nonetheless.

With this document, you can lay out how the company will operate, which keeps you from running into problems later down the line.

This can be as easy as laying out specific roles for individuals within the company or other specifications. To make matters better, once all the founders of your Nevada LLC have signed the operating agreement, it acts as a binding contract.

File for your EIN

Last but not least, you’ll need to obtain your EIN by filing on the IRS website.

You can also apply by fax or mail by completing this form and using this page to find the applicable phone or fax number.

Although this doesn’t apply to any U.S. residents, if you happen to be an international applicant, you can apply by calling 267-941-1099 from 6 a.m. to 11 p.m., any day of the week.

Handling your EIN application is completely free. Once the application is complete and your information validated, the EIN should be issued immediately.

Once you’ve handled all these steps, you are ready to go!

If you’re the sole member of the LLC and don’t want to be taxed as a corporation, you don’t have to obtain an EIN. That said, it’s highly advised that you do obtain an EIN because you’ll need it for things like business banking and loans.

Remember, the only way to get Nevada LLC benefits is by registering your business in the state. Below, we’ve gone into further detail about the best way to do this, so keep reading for more!

The best way to register an LLC in Nevada

Whether you are registering an LLC in Nevada as a local or from another location – using a Virtual Office is the best way to approach it.

To drive the point home, we’ve put together a list of some of the benefits associated with using a Virtual Office for your Nevada business registration. Keep reading to understand just how useful one of Alliance’s Virtual Offices is!

- Cost-efficient

- Private

- Register and operate from anywhere

- Onsite staff

- On-demand meeting spaces and workspaces

Cost-efficient

First, using one of Alliance’s Virtual Offices saves you money compared to a traditional office.

With traditional commercial leases, you’re looking at signing up for between 3 and 5 years. Not to mention, you’re expected to pay the first and last months’ rent in addition to any monthly utility fees.

Alliance provides business owners with a better way.

Not only do our plans start at a manageable 6-month minimum, but you only pay for office space when you need it and aren’t forced to worry about any monthly utility bills.

With these savings, it’s easier for you to grow your Nevada LLC by giving you more capital to invest in other areas.

Private

A Virtual Office makes it easy to protect your privacy.

Some business owners want to use their home addresses to register their virtual businesses, but making this decision can have disastrous consequences.

Namely, once you use your address, it becomes a part of the public domain. This means that scammers, disgruntled ex-employees, or frustrated customers have easy access to your personal information.

With a Virtual Office, you can use a professional address to register your business – keeping your personal information as private as possible.

Register and operate from anywhere

With a Virtual Office, you can register and operate from anywhere on the globe.

You can work remotely from your home or halfway across the planet; it doesn’t matter. You’ll have the same privileges regardless of where you’re working. Virtual Offices are built to accommodate nomadic entrepreneurs just as much as they’re built to accommodate static ones.

Read more: LLC for the Digital Entrepreneur: What You Need to Know When Traveling

Onsite staff

One of the biggest benefits of using our space-backed Virtual Offices is the friendly and helpful onsite staff.

Having access to a workspace is a massive benefit, but the benefit of having friendly and helpful onsite staff who are willing to walk you through any technical difficulties or other office-related struggles couldn’t be more valuable.

On-demand meeting spaces and workspaces

Best of all, you have access to on-demand meeting spaces that you can use when you need somewhere to host meetings and workspaces when you’d like to break the monotony of working from home.

Remote work does come with its own set of benefits, but two key issues that remote workers experience are the lack of space to host meetings and dealing with the frustrations of working from the same location that you eat and sleep in.

Often, remote workers will turn to coffee shops, expensive hotel conference rooms, or even worse, their homes to host meetings – which can negatively impact their company’s outward appearance.

Instead of risking your company’s privacy in a crowded coffee shop, paying the exorbitant fees required of a hotel conference room, or welcoming potential investors or clients into your home, you can use one of our easily reservable meeting rooms to pick the right-sized room to make the best impression.

For our workspaces, there’s nothing better than having somewhere to go when you’re feeling burnout coming on. Sometimes, breaking your daily routine and spending the day in one of our quiet and professional coworking spaces is all that it takes to get your motivation back.

The digital tools you can use to benefit your Nevada LLC

Filing an LLC is a straightforward process that can be done from the comfort of your home.

Choose a business name, designate a registered agent, submit your articles of organization and operating agreement, obtain an EIN, and you’re ready to do business in Nevada.

One of Alliance’s Virtual Offices is the best way to register because it protects your personal information and solidifies your business’s reputation, all while supporting your remote workstyle.

In addition to our Virtual Offices, Alliance provides other helpful digital tools that you can use to benefit your Nevada LLC.

For more information about the services that Alliance provides, check out the website here.

Also, check out the Alliance Virtual Office Blog for more informative pieces like this, from articles about virtual business registration to articles about sustainable business practices.

Further reading

- I Want to Start a Business But Have No Ideas… What Should I Do?

- LLC for the Digital Entrepreneur: What You Need to Know When Travelling

- Can I Be My Own Registered Agent?

- Payroll Loans for Small Business: Why Your Business Credit is Crucial

Alliance Virtual Offices provides several tools for everyone from established entrepreneurs to potential business owners. It doesn’t matter how much you know, we’re ready to teach you more.

For more information about how Alliance can help benefit your Nevada LLC, contact us today!