Categories:

Application server, Hardware, Module, Platform, Software

Commercial Contact:

Technical Contact:

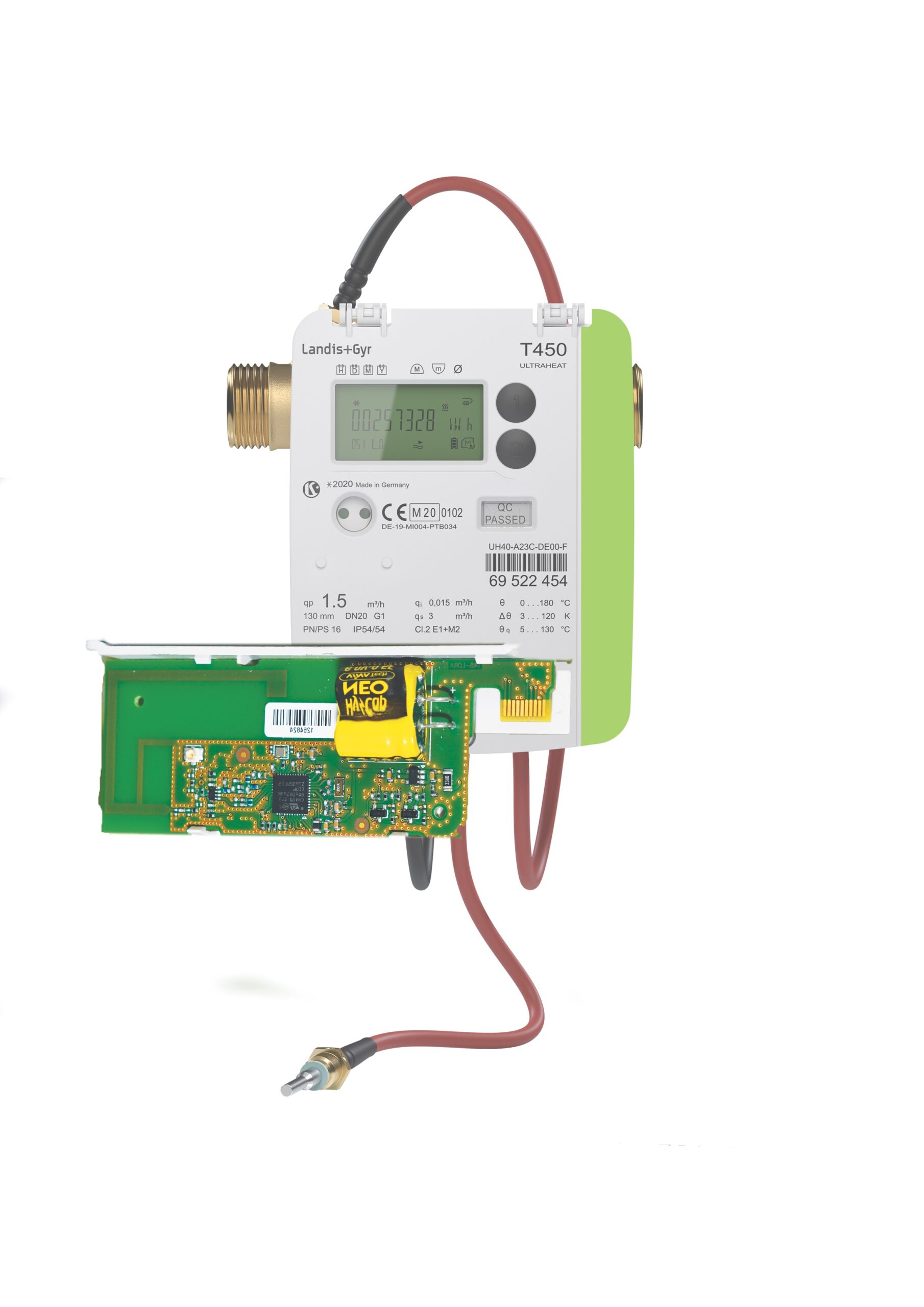

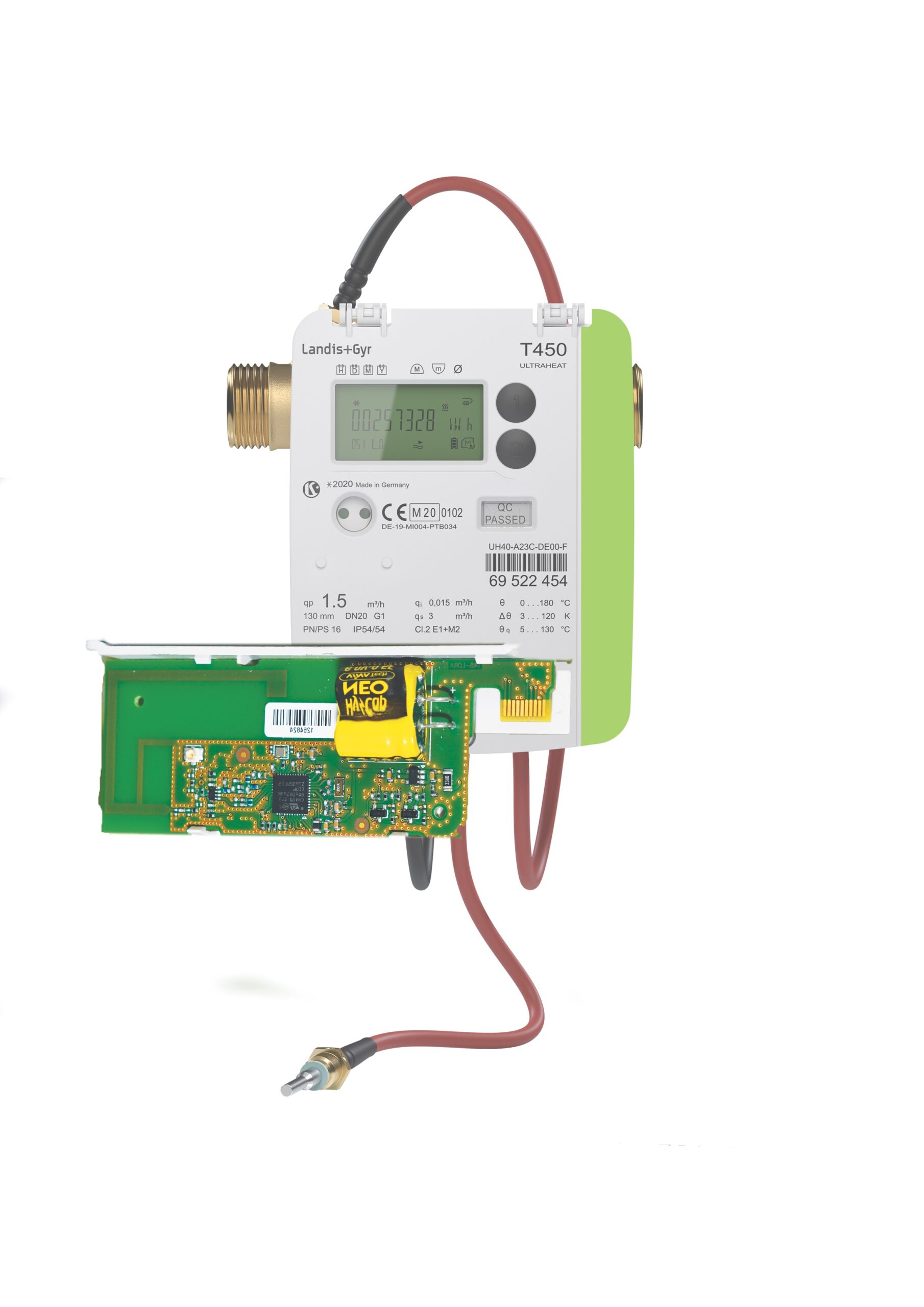

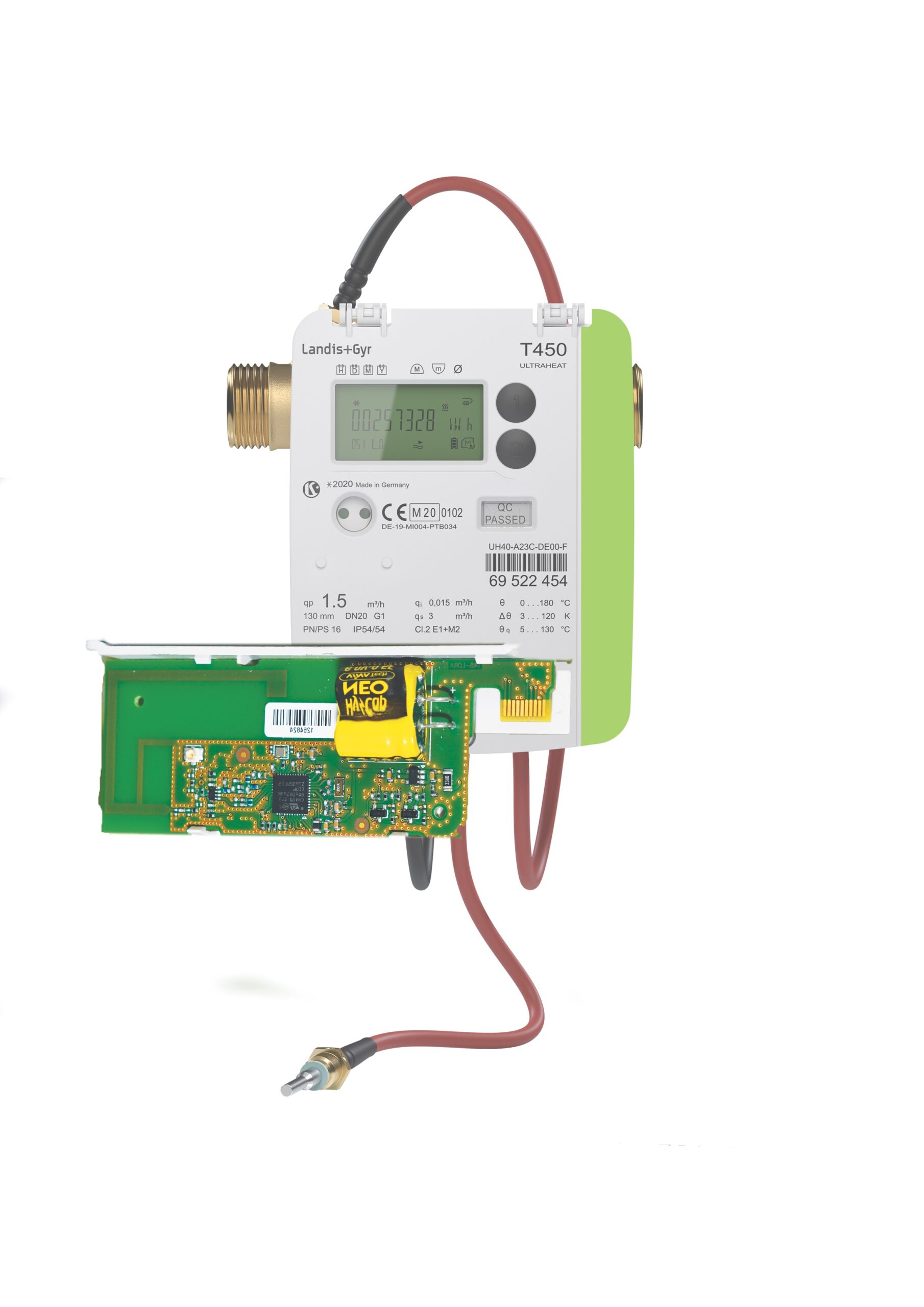

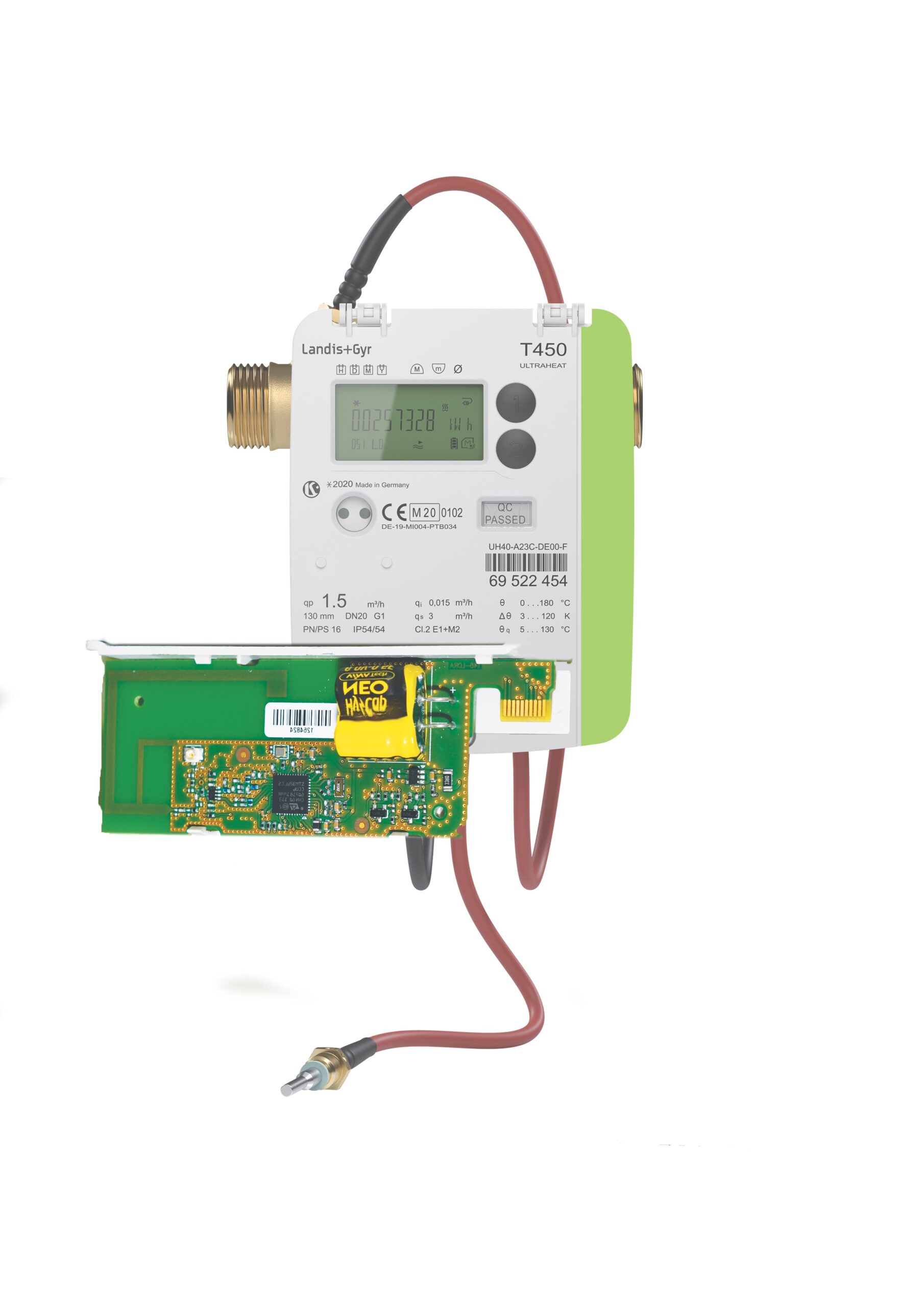

Landis + Gyr GmbH

Verticals:

Read the latest Beecham Research report: Leveraging LoRaWAN® for Smart Cities. Download Now

Landis + Gyr GmbH

Landis + Gyr GmbH

Something false on this page? Report